Welcome to Medicare Insider

Who We Are:

Medicare Insider is a trusted, independent resource created by pharmacists, actuaries, and healthcare consultants who’ve worked behind the scenes across the Medicare landscape.

We are not affiliated with any insurance plan or drug manufacturer.

Our mission is simple:

To help you understand the changes happening to Medicare Part D in 2026—and how those changes can unlock real savings on your prescription drugs.

Why We’re Here:

Turn Medicare’s Complexities Into Real Savings

This guide was built to help you save hundreds (or more) on your prescriptions by understanding what’s changing in 2026—and how to take full advantage.

Medicare is evolving- and while the new rules may sound complex, they also create new opportunities to cut costs (if you know where to look).

Small choices—like when you fill your meds, where you pick them up, or which plan you choose—can make a big difference in what you pay.

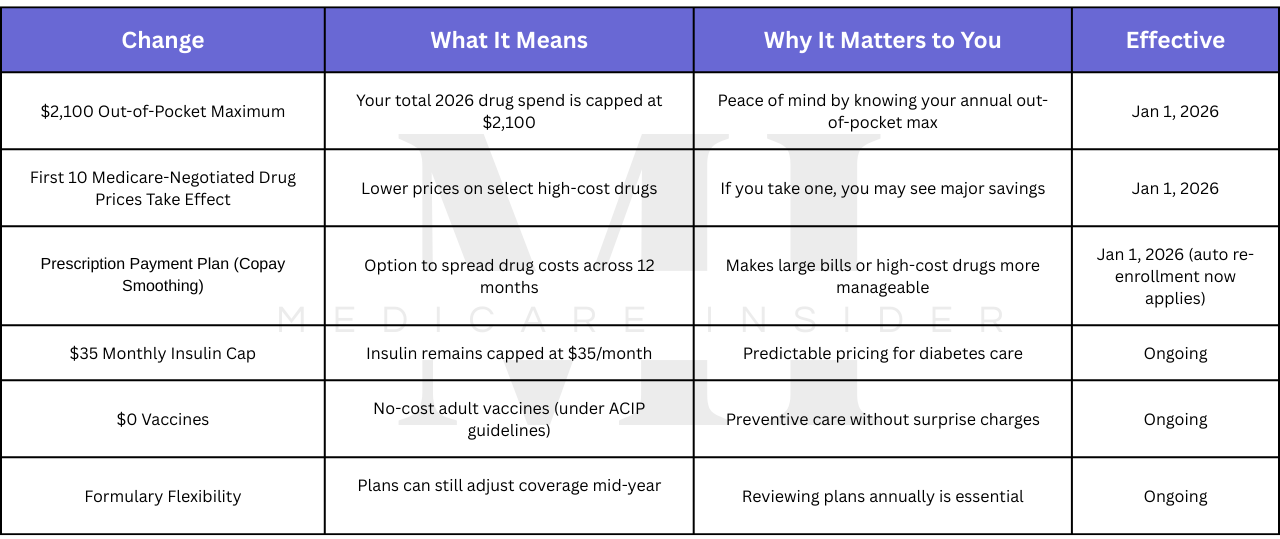

What’s Changing in 2026 — and Why It Matters

2026 builds on the drug benefit changes laid out in the Inflation Reduction Act (IRA)—and introduces even more ways to save. These changes are designed to reduce out-of-pocket spending and improve access to high-cost medications.

Each update creates a unique opportunity for significant savings:

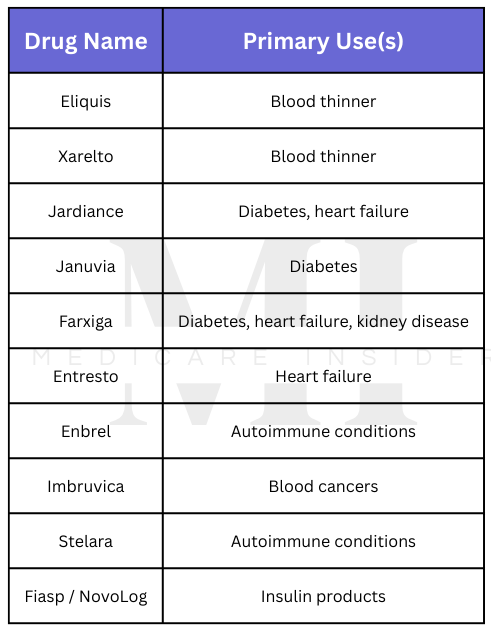

Which Drugs Were Negotiated for 2026?

The Inflation Reduction Act authorized Medicare to negotiate prices for the first time—and in 2026, the new negotiated prices take effect for these 10 drugs:

If you take one of these medications, your cost in 2026 will likely be significantly less

- Each of these medications have therapeutic alternatives that are NOT discounted in 2026. If you take a different medication for one of these conditions, ask your doctor if switching to one of these drugs would be appropriate

What’s Ahead

In the sections ahead, you’ll learn how to translate these 2026 changes into real savings—with practical examples, smart plan strategies, and insider guidance that puts you back in control of your prescription costs.

Understanding the Hidden Math of Medicare Drug Plans

It’s Not Just About the Premium

Medicare drug plans can look similar on the surface—but under the hood, they’re often very different.

Understanding how your plan is structured can be the difference between spending a few hundred dollars a year… or a few thousand.

Most people focus on the monthly premium. But the real costs come from how your plan handles:

- Deductibles

- Copays and coinsurance

- Medication tiers

- And how these interact with Medicare’s Defined Standard Benefit

What Is the Defined Standard Benefit?

Each year, Medicare sets a baseline plan design called the Defined Standard Benefit.

You don’t enroll in this directly—but every plan is measured against it behind the scenes.

Even if your plan includes better perks—like $0 deductibles or fixed $10 copays—Medicare still tracks your progress toward the $2,100 cap based on the greater of:

- What you actually pay, or

- What you would’ve paid under the Defined Standard Benefit

This is known as the “greater-of” logic—and it’s a key to saving money in 2026.

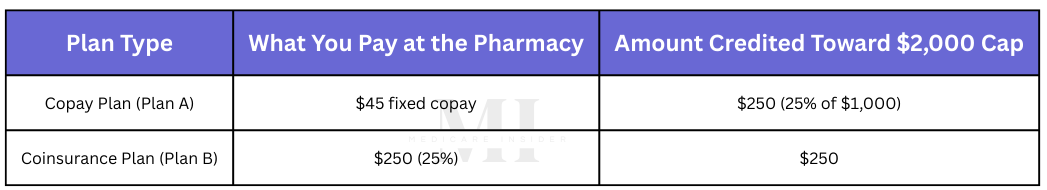

The “Greater-Of” Rule in Action:

Let’s say your medication costs $1,000 per fill. Depending on your plan, here’s what happens:

Takeaway:

Even if you only pay $45 at the pharmacy with Plan A, Medicare still credits $250 toward your $2,100 out-of-pocket max.

That means you can reach full coverage faster—without paying the full amount out of pocket.

Deductibles: Why $0 Might Be Worth It

Many people are drawn to low-premium plans…

But if that plan has a $600+ deductible, you’ll have to pay that out-of-pocket before coverage kicks in.

Plans with a $0 deductible may cost more per month—but if you take medications regularly, they could save you hundreds per year.

Example:

- If your plan has a high deductible, you could be paying full price for your drugs for months until your deductible is met

- With a $0-deductible plan, you start saving from your very first fill.

Copay vs. Coinsurance: The Hidden Cost Trap

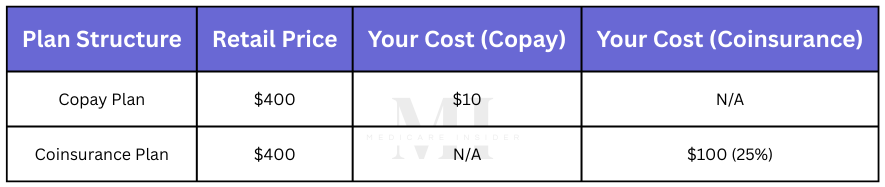

When it comes to drug coverage, almost all Medicare plans have multiple drug tiers as part of their plan design. However- Medicare plans can choose whether to assign each tier a flat copay or a coinsurance (which can create a huge opportunity for savings):

- Copay plans give you predictable prices.

- Coinsurance plans tie your cost to the retail price—which can fluctuate or spike unexpectedly.

The Bottom Line

When comparing plans, don’t just ask:

- “What’s the monthly premium?”

- “What will I pay at the pharmacy?”

Also ask:

- What tiers are my drugs covered on?

- Do these tiers have a copay or coinsurance?

- How quickly will I reach the $2,100 out-of-pocket cap?

By understanding how Medicare math really works—you can maximize savings and get to full coverage sooner.

Up Next:

See how one Medicare member can save over $350/month by switching to a smarter plan.

Real-World Strategy: How One Medicare Member Can Save Over $350/Month

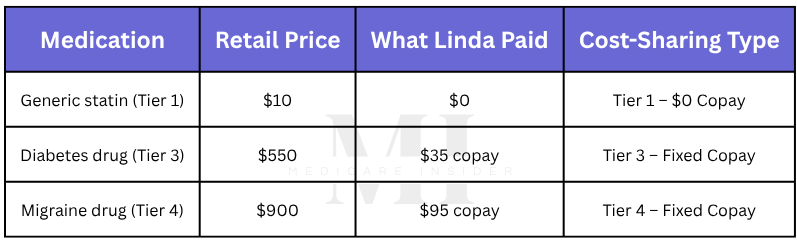

Meet Linda

Linda is a 72-year-old retired teacher. She takes the following medications regularly:

- A generic statin for cholesterol (Tier 1)

- A brand-name diabetes drug (Tier 3)

- An injectable drug to prevent migraines (Tier 4)

In 2025, Linda chose a Medicare Part D plan based mostly on its low monthly premium.

What she didn’t realize was:

- The plan included a $590 deductible

- The plan charged 25% coinsurance for Tier 3 and 40% for Tier 4

As a result, Linda faced unexpectedly high out-of-pocket costs—especially early in the year.

2025 Costs with a Deductible + Coinsurance Plan

Monthly Total: $507.50/month

Annualized: Over $6,000/year before she hit the cap

Even after meeting her deductible, Linda’s plan structure meant she continued paying hundreds per month due to coinsurance.

What She Can Do Differently in 2026

In 2026, Linda can review her options during open enrollment and chose a smarter plan that:

- Has a $0 deductible, so coverage starts immediately

- Uses fixed copays instead of coinsurance for Tier 3 and 4 drugs

This gives her predictable, lower monthly costs—and thanks to Medicare’s “greater-of” logic, she will reach the $2,100 out-of-pocket cap faster and with less out-of-pocket spending.

2026 Costs with a $0 Deductible + Copay-Based Plan

Monthly Total: $130/month

Monthly Savings (compared to 2025): $377.50

Annual Impact: Over $4,500 in reduced costs

And Thanks to the “Greater-Of” Rule…

Even though Linda will only pay $35 and $95 at the pharmacy, Medicare will credit 25% of the retail price toward her $2,100 cap:

- $137.50 credited for the diabetes drug (25% of the $550)

- $225 credited for the migraine drug (25% of the $900)

That means Linda will reach her $2,100 cap—WITHOUT actually paying the full $2,100 out-of-pocket

The Real Lesson:

Linda didn’t change her medications—she changed her plan.

By choosing a plan with no deductible and copay pricing instead of coinsurance, she:

- Can turn unpredictable pharmacy bills into fixed, manageable monthly payments

- Will reach the $2,100 cap faster—and pay less out of pocket to get there

Next Up:

While choosing the right plan is important, there are also smart strategies you can use right now—no matter which plan you’re already in.

In Section 4, we’ll show you how filling your prescriptions in a different order can stretch your benefits and save you even more in 2026.

Fill Smarter: How Prescription Timing Can Save You Hundreds

Most Medicare members don’t realize that when and how you fill your prescriptions can have a big impact on what you pay—especially under Medicare’s updated 2026 rules.

Here’s why:

Medicare tracks your out-of-pocket costs toward the $2,100 cap using the greater of:

- What you actually paid, or

- What you would’ve paid under the Defined Standard Benefit (25% of retail)

This creates a unique opportunity:

If you fill your medications strategically, you can often reach full coverage without actually spending $2,100 out of pocket.

Real-World Example: Copay First, Then Coinsurance

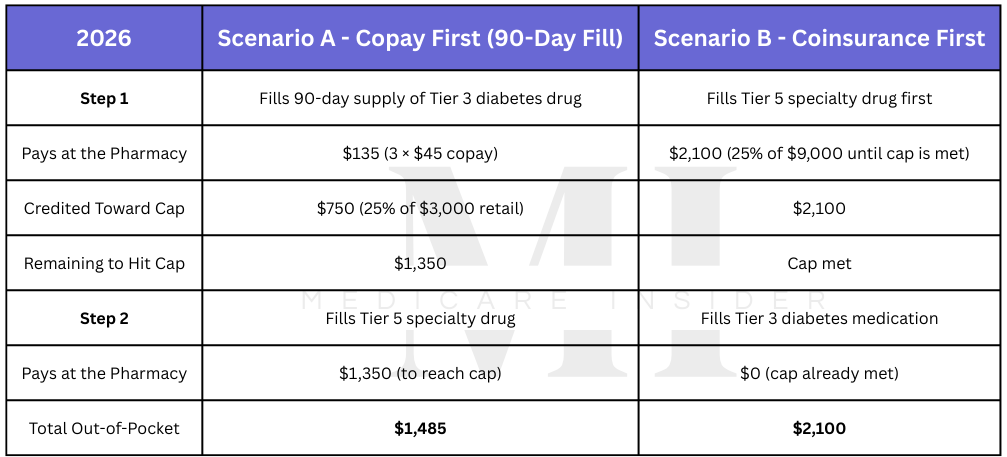

Let’s say a Medicare member takes:

- An injectable diabetes medication (Tier 3, approx. $1,000/month)

- An injectable autoimmune medication (Tier 5 specialty, approx. $9,000/month)

These are both high-cost medications—but they fall under different cost-sharing rules:

- Tier 3 medication has a $45 copay

- Tier 5 specialty medication uses 25% coinsurance

Two Ways to Fill — Two Very Different Outcomes

Same Medications. Same Plan. Different Fill Order.

By starting with a copay-based medication and using a 90-day supply, the member reaches the $2,100 cap faster on paper—without spending more in real dollars.

When they subsequently fill the high-cost specialty medication, there’s less remaining to pay.

Total savings: $615

Key Takeaways:

Quick Recap

Thanks to the “greater-of” rule:

- A flat copay can contribute hundreds more toward your $2,100 cap (compared to coinsurance)

- Copay-first + 90-day fill strategies can help you reach full coverage sooner

- You spend less and gain more coverage—simply by adjusting your refill order

Next:

In Section 5, we’ll wrap things up with bonus tips—small changes that can stretch your savings even further in 2026.

Bonus Tips: Maximize Savings with These Insider Moves

You’ve already learned the big strategies: how your plan structure, refill order, and fill timing can save you hundreds—if not thousands—on Medicare prescription costs.

But sometimes, the smallest adjustments can make the biggest difference when used consistently.

Here are a few bonus tips to stretch your savings even further:

- Use Preferred Pharmacies When Available

- Many plans offer lower copays or better pricing when you use a preferred pharmacy in their network.

- You might save $10–$50 or more per fill—just by switching locations.

- Choose 90-Day Fills When You Can

Filling a 90-day supply isn’t just convenient—it can also reduce your total costs by:

- Requiring fewer trips to the pharmacy

- Triggering fewer copays throughout the year

- Speeding up your progress toward the $2,100 out-of-pocket cap

Plus, 90-day fills often get higher credit under the “greater-of” rule—especially for fixed copay drugs.

- Ask About Lower-Tier Alternatives

Pharmacists often know of therapeutic equivalents in lower tiers that can provide similar results at a fraction of the cost.

Some may even be $0 under your plan.

Don’t hesitate to ask:

“Is there a lower-cost alternative to this drug that would work just as well for me?”

- Track Your Spending (Even If Your Plan Doesn’t)

Not all plans show you how close you are to hitting the $2,100 cap—especially in real time.

- Keep a running tally, or

- Ask your pharmacy for a monthly benefits summary

You might be closer than you think.

- Fill Lower-Cost Medications First

If you're taking both lower-cost and high-cost medications:

Start with the lower-cost ones—especially if they have copays.

Why? Because:

- These fills still move you closer to the $2,100 cap, AND

- Medicare may credit more than you actually paid (thanks to the greater-of rule)

That means if/when you need to fill more expensive medications, you will likely have to pay less in order to meet the $2,100 out-of-pocket cap

Final Thoughts

The changes happening to Medicare Part D in 2026 are some of the most impactful in years.

If you understand how these changes work—and how to take advantage of them—they can lead to real, lasting savings on your prescriptions.

That’s why we created this guide.

Not to promote any plan. Not to promote any drug.

But to help you understand what’s changing, how those changes affect you, and how to get the most value from your Medicare benefits.

Whether you're:

- Reviewing your current plan

- Supporting a spouse or parent

- Planning ahead for open enrollment

- Or just trying to make sense of your costs—

Just remember:

The right information and a few smart strategies can help you take control of your Medicare coverage—and save more than you ever thought possible.

Want Help Reviewing Your Specific Medications?

If this guide helped you understand Medicare better—but you’d like help applying these strategies to your specific prescriptions and plan, we’ve got you covered.

We offer private consultations with a licensed Medicare pharmacist who will:

- Review your current prescriptions and plan coverage

- Compare plan options based on your unique needs

- Identify areas where you may be overpaying—and how to fix it

- Help you prepare for open enrollment with confidence

Consultation Fee: $350 flat

Includes a personalized review, strategy session, and a written summary of recommendations.

No sales pitch. No plan affiliations. Just clear, unbiased advice to help you save.

Ready to book your session?